Write Off Bad Debt Double Entry

The vouchers can be exchanged for entry at Alton Towers Thorpe Park Legoland Chessington Sea Life Centres Madame Tussauds and more see the full list of Merlin attractionsHowever its more of a 2for1 ticket as to get the. The accounts receivable journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of accounts receivable.

Bad Debt Overview Example Bad Debt Expense Journal Entries

Another double entry bookkeeping example for you to discover.

. Heres how to do it. The journal entry to record the bad debt recovered is debit cash and credit other income. Currently promotional packs of Kelloggs cereal and snacks offer a Free Adult Ticket voucher for over 30 UK Merlin theme parks and attractions.

Estimating the time it takes to get a divorce includes factors such as where you live if your state has a cooling off period or required period of Jul 15 2022 5 min read 9 Divorce FAQ Answers to Frequently Asked Questions About Alimony Child Custody and Child Support. It is not directly affected by the journal entry write-off. May 02 2022 4 min read.

The Bad Debts Expense remains at 10000. Read the full article on how to write off the account receivable. The IRS says that bad debts include loans to clients and suppliers credit sales to customers and business loan guarantees and that a business deducts its bad debts in full or in part from gross income when.

Bad debt can also result from a customer going bankrupt and being financially incapable of paying back their debts. Supplies of food and other necessary things. May 02 2022 3 min read.

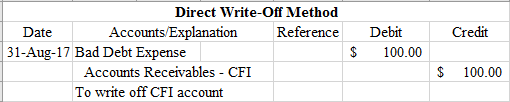

In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. Bad Debt Write Off - A customer has been invoiced 200 for goods and the business decided the debt will not be paid and needs to post a bad debt write off. When businesses file their income tax return they are able to write off expenses incurred to.

Last modified November 25th. The bad debts expense recorded on June 30 and July 31 had anticipated a credit loss such as this. Write something off definition.

Cash Shortage Journal Entry. It would be double counting for Gem to record both an anticipated estimate of a credit loss and the actual credit loss. The act of providing something.

The main reason that it is recorded as the other. To accept that an amount of money has been lost or that a debt will not be paid. Nineteen Eighty-Four also stylised as 1984 is a dystopian social science fiction novel and cautionary tale written by the English writer George OrwellIt was published on 8 June 1949 by Secker Warburg as Orwells ninth and final book completed in his lifetime.

Allowance for Doubtful Accounts. A write-off is a deduction in the value of earnings by the amount of an expense or loss. Debit Bad debts 500 PL.

The following accounting double entry will be passed in the books of the company. Thematically it centres on the consequences of totalitarianism mass surveillance and repressive. How to Get a Divorce Online If your divorce is uncontested filing online may be the way to go.

When it comes time to go your separate ways someone has to take responsibility for your debt.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Writing Off An Account Under The Allowance Method Accountingcoach

Allowance Method For Bad Debt Double Entry Bookkeeping

0 Response to "Write Off Bad Debt Double Entry"

Post a Comment